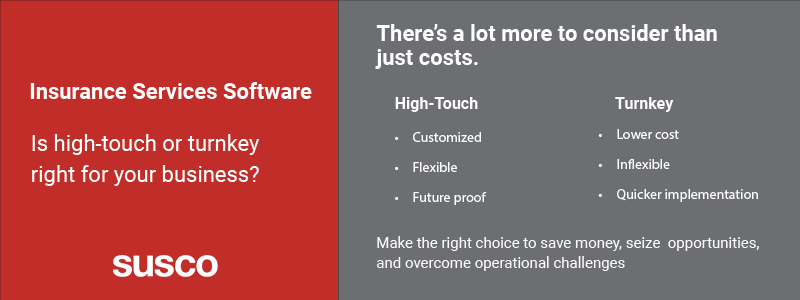

There’s a lot more to consider than just insurance software costs. Weigh your options.

For insurance adjusting firms, one software solution does not fit all needs. Do you need a high-touch insurance software service model or a turnkey answer? This is often a pain point, and making the right decision can be challenging. Both models come with benefits and drawbacks, so which do you choose?

An uninformed or hasty decision can cost your business, creating financial woes, operational challenges, or hamper growth. It is critical to get the whole picture to understand the implications, costs, and benefits of each model so you can choose the solution that aligns with overall company objectives and creates a seamless experience.

In this article, you’ll learn the differences and pros and cons between high-touch and turnkey models and the importance of evaluating your firm’s current and future needs when choosing an insurance software service model.

The models

In the context of software service solutions, the word “touch” means the level of human interaction required to both purchase and use the service. Activities like vendor onboarding, application customizations, consulting, and account management each constitute a touch.

High-touch solutions

A high-touch solution, as the name implies, offers an experience tailored to your firm’s specific needs, offering one-on-one assistance with

- A customized, hands-on approach

- Direct, consistent, and continuous vendor-client engagement

- Bespoke features and integrations

A high-touch solution means custom software development that meets your firm’s unique challenges while capitalizing on its strengths. This gives you flexibility and scalability that will enable you to move confidently into the future.

Turnkey solutions

Turnkey solutions are useful for firms who want to solve one particular issue. While convenient, this type of solution lacks the customization component that’s critical for business today and tomorrow. Rather than offering a tailored solution, these off-the-shelf, pre-built options are designed for the lowest common denominator in a particular industry, with standardized features that meet only general needs.

The pros and cons of each insurance software service model

Each model has its advantages and its challenges, of course. Let’s take a look.

The high-touch insurance software service model

High touch means highly customized, offering advantages your business can use to seize opportunities, become more efficient, and increase profits.

The pros of a custom solution include:

- Easy integration with existing system

- A smooth transition with little disruption

- Software built with the future in mind that can meet evolving business needs

- Software designed specifically for your firm and its unique challenges

- Personalized workflows that precisely align with your objectives

- Continuous vendor support and bespoke modifications as needed

The cons

In terms of costs, there’s a delicate balance to consider. While the initial investment for a custom solution may be higher than that for out-of-the-box software, it ultimately leads to lower insurance software costs in the long term. You won’t need to add new software to address emerging issues continually. Instead, you can easily make adjustments and enhancements, making the high-touch model a more cost-effective choice over time.

It’s important to note that to meet a business’s specific needs, implementation time is longer with a custom solution.

The turnkey insurance software service model

Turnkey, out-of-the-box, or off-the-shelf software has advantages, chief among them an initial savings in insurance software costs. Another pro is fast deployment. This solution also offers the advantage of ease-of-use due to standard features, which also serve as a disadvantage.

The cons

- High potential for compatibility issues

- May not fit with the existing infrastructure

- Lacks the scalability and flexibility needed to meet evolving business needs

- Offers only pre-defined features that may not match existing processes or objectives

- Little to no customization options.

- May require adjusting your processes to meet that of the software.

Make an informed decision

There’s a lot to consider, including choosing the right vendor. Even with a turnkey solution, you’ll need to analyze your current IT environment to know what you need. And you must do your homework before you start looking for a vendor.

Define your specific requirements.

What do you want to achieve with new software? Areas to cover include your firm’s specific goals, challenges, and pain points, as well as the features and functions you need. Remember to include all regulatory compliance requirements – a vendor with experience in the insurance industry is a real advantage here.

Evaluate your current and future needs

The software solution you select should not just meet you where you are now – it should take you where you want to go. Do your research. What are emerging trends in your industry, and how can software help you use them to your advantage? How big do you want to get? If your objective is to grow, you’ll need software that gives you scalability.

Do you need unique features?

If you’re satisfied with out-of-the-box features, turnkey is your model. However, if you find yourself or your staff frequently saying, “I wish this software could do this,” or “I wish I could pull a report like this,” a custom solution is the way to go. You can add the features you need and make your daily operations more efficient.

What’s your budget and timeline?

Turnkey solutions are quick to implement—about half the implementation time of a tailored product. When it comes to insurance software costs, off-the-shelf is less expensive in the short run, but as has been illustrated, it can cost you more in the long run.

What about vendor support?

Because the turnkey model involves an off-the-shelf solution designed by a third party, the vendor you choose can only offer limited support. Most support will come from the software company and is often limited without paying additional fees. No training is included.

In contrast, the high-touch model offers extensive vendor support before, during, and after design and implementation. The process will start with analysis, move on to designing your customized solution, and then move on to development and testing.

Training is provided so that your IT team is well-equipped to integrate any new hires. Documentation is provided via user guides or video walk-throughs, again customized to your needs. Lastly comes implementation.

It’s all done with close collaboration and continuous communication, so you get exactly what you need to make your business thrive.

The bottom line

When selecting an insurance software service model, there’s a lot to consider, but it comes down to what best meets the needs of your company, both in the short and long term. The goal is optimization and business outcomes that meet your overall objectives.

When you decide (because of overwhelming evidence) that a custom software solution is right for your firm, your first move should be to contact Susco. We make your business more efficient, boost your workflow, close operational gaps, and help you communicate effectively internally and externally. Get faster, better, stronger, and boost revenue.

For more than a decade, our dedicated team of web and application developers has built custom solutions for insurance adjusting firms that perfectly align with business goals. Discover what we can do for you. Get in touch today so we can schedule your free one-hour assessment.