Enhancing the efficiency of legacy insurance systems is a competitive imperative

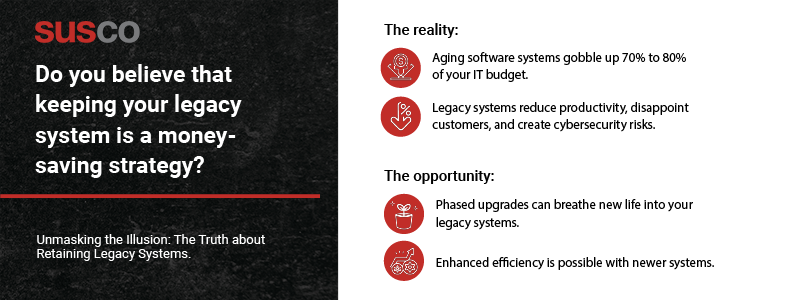

Legacy software challenges plague many insurance adjusting firms, eating up 70% to 80% of IT budgets and leaving little money for innovation. Outdated software solutions also stifle growth by hindering scalability, cratering efficiency, and leaving the door open for cybercriminals. To keep a competitive edge, upgrading these old systems is a must for meeting these challenges and increasing efficiency.

Today’s business environment marches to the drumbeat of digital transformation. While mothballing older technology is likely necessary, making the leadership decision to take the leap can be a daunting task. However, what many business leaders fail to realize is that change does not have to happen all at once. The path forward can blend current systems with new technology, enhancing the efficiency of legacy insurance systems as you ease toward replacing them.

The right software development partner can boost your existing systems as you work on a strategy for a complete system upgrade. In this article, we’ll dive into how legacy software hurts your business, look at strategies to enhance your legacy system, and provide clues for knowing when it’s time for the system upgrade essential to current and future success.

The legacy insurance software challenges

The insurance industry is notorious for its outdated technology. While some modifications and upgrades may have been made to accommodate pandemic-era restrictions, many firms still depend on old technology. Reliance on older systems, however, can come at quite a cost.

- Legacy technology is expensive in more ways than one.

You may think you’re saving money by maintaining that legacy system, but you’re really incurring technical debt by throwing good money after bad. Like all debts, they ultimately come due. The older a system is, the more it costs to maintain, but that’s not the only cost.

Legacy technology is eating away at your bottom line in less apparent ways. Outdated software can’t offer the features and ease of use your clients, employees, and vendors expect. If you don’t give them the experience they want, they will go to a competitor that does.

- Reputational harm.

You’ve worked hard to build and keep your adjusting firm’s reputation. Risking that stellar reputation on outdated technology can drag your brand through the mud – just look at the recent Southwest Airlines debacle.

It doesn’t take a complete system failure to create a negative view of your firm. Users frustrated by outdated interfaces or non-intuitive workflows will flock to the competition for better experiences. Your firm will be seen as stuck in the past and behind the times.

- Regulatory risk.

No one has to tell you that insurance regulations are complex. Not only are there national rules – but state-by-state regulations provide additional complexity. Using paper-based and manual efforts to work through these regulatory considerations creates an opportunity for human error. Updating to an automated, integrated compliance solution will save you money on internal resources and ensure compliance.

- Inhibited growth.

Your legacy system has reached its maximum capacity, hindering further growth. It no longer aligns with your present requirements, raising questions about its suitability for facilitating expansion. To adequately address current market demands and capture new market opportunities, your system needs to scale.

- Inefficient workflows and lost productivity.

Manual input. Repetitive, non-revenue-generating tasks. Human error. You’re wasting talent and time and risking noncompliance. The absence of updated technology hinders the seamless flow of valuable data stored in workflow silos, impeding operational efficiency and overall progress.

- Cyber attack vulnerability.

Cybercriminals love any company dealing with insurance. So much rich data. So much personal information. Your legacy system likely doesn’t have the defenses it needs to defend – not to mention detect – cyber threats. Bad actors are exploiting your technology to compromise your security, underscoring the need for advanced technology solutions to counteract these threats.

Otherwise, you risk reputational damage, not to mention the high financial costs of dealing with a data breach. Ransomware is the most likely mode of attack, and even after you pay, you’ll likely only recover 8% of your data.

- Integration issues with new technology.

If your current system was built using outdated technology, it’s likely incompatible with newer systems, leading to problems with integration, data loss, and even total system failure. A lack of documentation complicates the process, and the limited functionality of your legacy software can lack the capability to handle modern applications and data, slowing productivity efficiently.

These are all compelling reasons to upgrade your technology stack, but enhancing the efficiency of legacy insurance systems and dealing with legacy insurance software challenges doesn’t have to mean an immediate overhaul.

Strategies to enhance the efficiency of legacy systems

There are practical solutions to optimize workflows and provide stronger cybersecurity within your current technology environment. While these strategies are not complete replacements for a comprehensive system overhaul, they offer valuable interim measures.

- Modular enhancements can be made without overhauling the existing system. APIs can expand your system and integrate it with newer technologies, reduce maintenance costs, and make the development process easier to introduce new features.

- Middleware can bridge gaps to provide modern capabilities for digitization.

- Periodic maintenance and security patches can keep software updated to the highest compatible version, and security patches can help keep your system and your client’s data safe.

- Staff training to make the most of existing tools offers a productivity boost.

The reality check: transition is inevitable

As the television trope espouses, “Resistance is futile.” The limitations and problems caused by legacy systems can be outrun. Technology marches on. It’s time to replace your technology infrastructure if:

- Its developers no longer support applications and other software, and you’re not even receiving security updates.

- Your hardware or infrastructure limitations no longer allow you to install updates or upgrades.

- Compatibility issues won’t allow integration of new technology.

- Your servers lack the power to run the latest software.

How to weigh the long-term benefits against short-term costs

The piper must be paid one way or the other. Digital transformation may seem costly, but avoiding the investment costs more. If you don’t grow, you lose market share. Without upgrading your legacy system, you face every legacy software challenge in this blog. Do it, and you gain a competitive advantage. Don’t do it, and you’ll struggle to stay competitive.

Digital transformation has a significant ROI over the long term. The costs directly relate to your company’s size and complexity and how long you’ve been hanging on to that legacy system. The size of associated technical debt and data complexity and volume also factor into this equation.

The most efficient way of enhancing the efficiency of legacy insurance systems is to hire the right partner – one with a long history of helping the insurance industry modernize its technology. They’ll conduct a needs assessment, use an agile approach, and make sure you have exactly the technology you need to scale your business.

Gain a competitive edge in a competitive industry

Maintaining the status quo is a dead-end approach when objectively evaluating your operations. Insurance adjusting firms with the foresight to step outside of their comfort zone will be able to seize new opportunities, make current clients happy, and get the technology framework that keeps them successful far into the future.

Partnering with Susco means partnering with a team fully invested in the insurance industry for more than a decade. We leverage the latest technology to create custom software solutions that give your workflow a decisive boost, close operational gaps, and help you communicate more effectively both internally and externally.

With us, you’ll get a dedicated team of web and application developers dedicated to building solutions that align with your business goals. Discover what we can do for you. Get in touch today so we can schedule your free one-hour assessment.