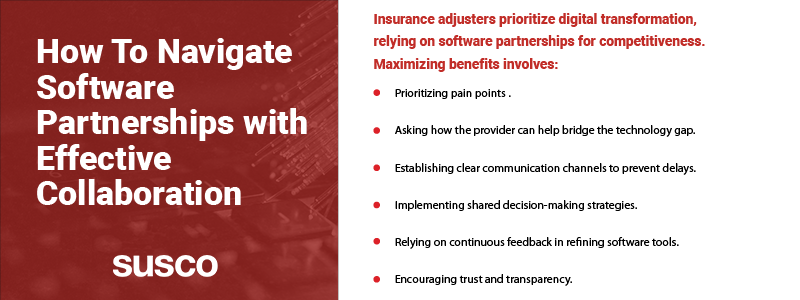

As digital transformation becomes a priority in insurance, adjusters have turned to software partners to stay competitive. Properly navigating these partnerships is key to maximizing benefits.

The insurance industry has changed drastically with widespread digitization and the emergence of new technologies. Customers now demand efficiency and speed in claims resolution and a seamless digital experience. Forward-thinking companies are working towards digital transformation to maintain their edge. Unfortunately, persistent labor shortages have left them scrambling for tech talent in a dwindling pool.

It’s clear that technology is the sole distinguisher for leading insurance adjusting firms—while stellar customer service remains crucial, adjusters can’t maximize operational efficiency and profitability without cutting-edge technology. The main problem many adjusters face is that they lack the resources and expertise to maximize its benefits.

Fortunately, strategic software partnerships with Insuretech companies can help turn things around. These partnerships help adjusters replace time- and labor-intensive, error-prone manual processes with digital ones that expedite data exchanges, provide instant connections with critical third-party services, allow efficient document creation, tracking, and sharing, and more.

Here’s how to maximize the benefits of strategic software partnerships in the insurance-adjusting sector.

Aligning Software Solutions with Adjusting Needs

Strategic software partnerships give insurers unprecedented access to the latest tools and technologies. However, to make the most of these partnerships, it is essential to identify software features that meet the specific operational needs of the adjusting business.

These software features are must-haves:

- Integration: Insurance adjusters increasingly rely on core business applications and third-party services to run their daily operations. Therefore, software that easily integrates with existing solutions is needed for seamless connectivity of the digital ecosystem.

- Automation: Artificial intelligence (AI) and intelligent automation provide an immediate edge when implemented in insurance software; workflows become more consistent, accurate, and efficient. So, the software solutions you use must allow you to configure rules for automating claim filing and processing, data entry, fraud detection, roster management, and other vital business processes.

- Security: Regulators increasingly hold insurance adjusters to extremely high standards due to the high volume and sensitive nature of the data they handle. This makes robust security a non-negotiable priority. Prioritizing software with features such as data encryption, multi-factor authentication, and role-based access controls (RBAC) ensures adjusters operate within compliance and regulatory guidelines.

- Scalability: Scalability secures your software investment. Custom software solutions that allow you to evolve capabilities when needs change are crucial when leveraging technology as a growth driver in insurance.

Clear, effective communication is also essential for successful collaboration with the software partner. Without it, vital information could get lost in translation, and misunderstandings could arise.

Communication: The Backbone of Collaboration

Understanding the software partner’s expectations and goals is a great starting point for collaboration. It helps you develop a shared vision of the development project and find ways to align resources, feedback mechanisms, and strategies. Some important questions to ask include:

- What is the software partner trying to achieve?

- What are their milestones and timelines?

- How do they measure success?

After answering these questions, determine the best communication channels. Depending on the scope and nature of the project, you may need different tools and platforms for reporting, testing, documentation, project management, and data sharing. And that’s okay. But ensure you’re on the same page about these channels and that your team has training and access to use them properly.

Remember to establish effective communication protocols and routines. Clarify these questions:

- Who are the main stakeholders and contacts on both sides?

- How often will you communicate, and with what agenda?

- How will you resolve conflicts and escalate issues?

A consistent and clear communication process and schedule can help avoid gaps in information, delays, and misunderstandings.

Decision-Making: A Joint Effort

The software provider and the adjusting firm are experts in their respective fields. And there’s power in synergy. So, instead of using a top-down decision-making approach, why not co-innovate and co-create? Treat the software partner as a strategic asset in the decision-making pipeline. Solicit their input when brainstorming potential software ideas to improve adjusting operations, evaluate options together, and make the final choice through consensus-building or voting.

Feedback and Adjustments: Ensuring Mutual Satisfaction

Continuous feedback is crucial in refining software tools for optimal insurance adjusting outcomes. By providing the software partner constructive feedback early and often, they can:

- Identify and address software issues before they become problematic.

- Quickly adapt the software to changing requirements.

- Develop a solution that aligns with business objectives and delivers the most value for the adjusting firm.

To make continuous feedback work, both parties must actively participate, and a culture of transparency and openness that values and welcomes feedback must exist. Additionally, clear processes and mechanisms for prioritizing feedback should ensure that the most critical aspects are addressed first and that all issues are addressed over time.

Building Trust through Transparency and Reliability

Transparency and reliability are crucial to establishing trust in partnerships. Luckily, there are strategies to improve oversight and deepen relationships with software partners: leveraging technology to facilitate contractual agreements, increasing the monitoring and evaluation of partners, and adopting digital tools to facilitate data and information sharing. These strategies help you navigate partnerships with confidence, knowing that the software provider will stay accountable every step of the way.

Strengthening Adjusting Operations Through Partnership

The right software partnership can mean all the difference in adjusting operations. Without the right partner and software, there will be claims processing delays, cost hurdles, reduced productivity, poor customer and employee experience, and lower return on investment (ROI). These factors can hurt your bottom line and deflate your ability to complete. Luckily, you can stay ahead of the digital curve with a well-navigated software partnership.

As you strive to strengthen your insurance adjusting operations through partnership, consider Susco Solutions. We make custom, intuitive software that’s responsive to your business needs. Whether you want a solution that improves the service design, generates custom reporting, automates processes, ensures robust security, or scales on demand, we’ve got you covered. Susco experts leave no stone unturned in the quest for customer satisfaction and efficiency. Contact us today to learn more.