Which solution will propel your adjusting firm to the greatest success?

Key Takeaways:

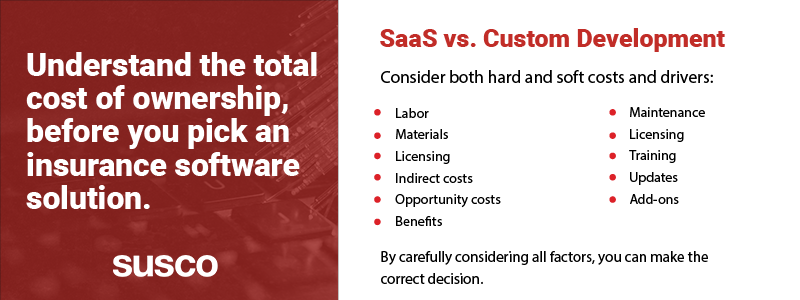

- The correct solution – SaaS vs. custom development is a critical decision

- Of utmost consideration is the total cost of ownership (TOC)

- Calculations must include both hard and soft costs

- Only by carefully considering all factors can you make the correct decision

Today’s insurance world, and indeed the world at large, is digital. Choosing the correct software and software delivery method is vital to leveraging all the benefits of efficiency, cost savings, boosted productivity, and improved customer service.

Choosing the right solution for your adjusting firm can be confusing, and a misstep can be costly. So, which is right for you? A software-as-a-service (SaaS) product or custom development? What about the total cost of ownership (TCO)? What can appear to be a cost-effective solution can become expensive down the line.

In the battle of SaaS versus custom software, which comes out ahead? What will your IT budget look like within your overall financial plan? Which solution will best meet your overall financial and operational objectives? In this article, we offer an insurance total cost of ownership comparison between SaaS solutions and custom software development so you can make an informed decision.

How to calculate the total cost of ownership

The total cost of ownership is the initial cost plus the operational cost over the lifespan of your software solution and is a method to assess the long-term value. Using TCO means taking a holistic approach that evaluates options from a broad perspective, including the initial price and direct and indirect expenses.

1. Develop a framework

Your framework outlines your goals and objectives for your software. Is it to replace disparate legacy tools with an integrated solution? Is it to add automation for repetitive tasks? Or perhaps you’re concerned about cybersecurity.

It’s also important to develop metrics that you’ll apply to both solutions so you can make an apples-to-apples comparison of costs and benefits

2. Calculate all costs

The initial cost of SaaS vs custom software won’t give you a TCO. You must include direct costs, which are either the initial cost of SaaS or the development of custom software, including labor, materials, and licensing, and indirect costs, which include your overhead costs, including rent and utilities, etc. It’s important to remember that TCO also should consider things like support, training, and hosting.

3. Don’t forget about the benefits

An essential part of calculating TCO is including the benefits. You’ll include:

- Measurable benefits like revenue, profit, and sales.

- Indirect benefits are qualitative perks that can’t be measured. They are perceived, and include expanded customer reach and brand awareness. They can also include improved employee morale.

- Competitive benefits come from improved processes and efficiencies that surpass that of other firms.

4. Now, compare

To get the final value, also called your return on investment (ROI), you’ll now compare the information you’ve compiled.

Calculating the total cost of ownership is vital to prevent unnecessary losses that can arise in the future when you just focus on the initial direct costs of purchase. For example, when you buy a car beyond the purchase price you also must calculate the after-sale costs of repairs, insurance, and fuel over the lifespan of the vehicle. After-the-sale costs also come into play when looking at SaaS vs. custom software development.

Calculate the real cost of SaaS solutions

Off-the-shelf or plug-and-play SaaS solutions can offer a cheaper cost of entry. To calculate the TCO, you’ll need to consider the following:

Initial setup and subscription fees

Be careful here to get the total cost. Some SaaS providers offer tiered licensing that can look inexpensive, but as your business grows, you’ll be paying for more licenses, making it difficult to calculate the TCO. And if someone leaves your firm and you don’t have a well-structured process, you may continue to pay for a license you’re not even using.

Maintenance and update expenses

With SaaS, which is cloud-based, there’s no maintenance involved, and updates happen automatically. However, you will get new versions and updates whether you want them or not, which can require additional training.

Training and implementation costs

Since you’re buying an off-the-shelf product, no training is provided. You’ll have to hire trainers who are specialists in the software you purchased.

As a benchmark, the average cost of training new employees on new technology is $24,800 per worker. Implementation? That’s up to your internal IT team.

Scalability and the potential for hidden costs

We’ve already pointed out how tiered licensing can be a hidden expense, but there are some other elements you should consider.

Add-ons. Some SaaS solutions give you inexpensive or free access to basic functions. However, you’ll pay a premium for add-ons. Let’s say you purchase a customer management solution. You may get a good deal on basic functions, but if you want advanced features or the ability to perform data analysis.

Fees for licenses you don’t need. Suppose you upgraded to the enterprise version of SaaS software, and some employees leave. You may drop below the enterprise threshold, but you’re still paying the higher price for licensing.

Paying for apps you don’t use. As updates and upgrades happen, you may pay for redundant software or overlapping services.

When it comes to scalability, it’s essential to remember that SaaS software is built using a templated system that may be incompatible with growth and change. New software will likely need to be added to keep up.

When looking at the TCO for SaaS solutions, you can see that both direct and indirect costs must be considered, and one of the most important is the flexibility of the software to meet your firm’s growing needs.

A dive into the financial impact of custom software development

Custom software development offers scalability and adaptability that SaaS just can’t match. You’ll get software custom-tailored to your firm’s needs and long-term goals, a high level of cybersecurity, and built-in compliance controls, and you won’t be paying for licenses or applications you don’t need or want.

To calculate the TCO of custom software, consider:

- Initial development cost. This cost will depend on factors such as the scope and complexity, technical requirements, and your project timeline.

- Maintenance and updates. You’ll want to budget about 20% of the initial development cost for annual maintenance and updates. This would include adding capabilities, maintaining performance, or making changes.

- Training, onboarding, and implementation. Rather than hiring outside trainers, training for your IT is included in custom software development. Your provider will ensure that the key people in your company understand the system and can teach others. Training documentation – a user guide or video walkthroughs – can also be provided as part of the project scope.

- Hands-on support. Your custom software development partner will be there every step of the way for implementation, developing a relationship through continual communication and helping to ensure your system meets your overall goals.

- Scalability and adaptability. Custom solutions are infinitely scalable, and because the solution is custom-created for your firm, it’s easily adaptable to meet changing needs.

The bottom line

When assessing SaaS vs. custom software, the deciding factor should be an accurately calculated TCO. The bottom line is business value. What will drive your business forward? Weigh all the pros and cons, not just the financial ones. Consider the soft costs as well, as each solution’s effect on your processes, people, and competitive advantage.

When you decide a custom software solution is right for your firm, contact Susco. We’ll design, build, implement, and train on software that precisely meets your firm’s needs, with nothing you don’t want. Get faster, better, stronger, and increase revenue.

For more than a decade, our dedicated team of web and application developers has built custom solutions for insurance adjusting firms that perfectly align with business goals. Discover what we can do for you. Get in touch today so we can schedule your free one-hour assessment.