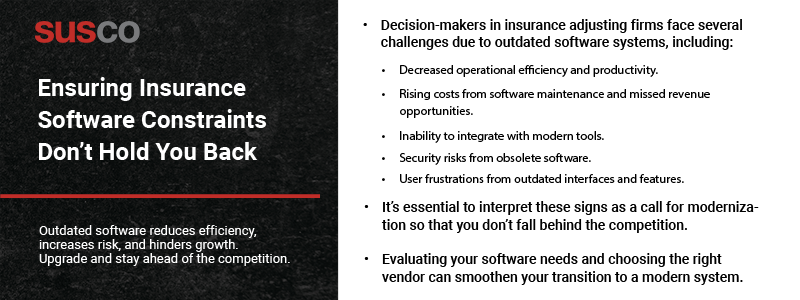

Insurance software constraints can reduce operational efficiency, increase security risks, and make it hard to grow. Recognizing these limitations and proceeding with timely upgrades can give you an edge.

Key takeaways:

- Decision-makers in insurance adjusting firms face several challenges due to outdated software systems, including:

- Decreased operational efficiency and productivity.

- Rising costs from software maintenance and missed revenue opportunities.

- Inability to integrate with modern tools.

- Security risks from obsolete software.

- User frustrations from outdated interfaces and features.

- It’s essential to interpret these signs as a call for modernization so that you don’t fall behind the competition.

- Evaluating your software needs and choosing the right vendor can smoothen your transition to a modern system.

Your software can catalyze growth, delivering reliable performance, higher cost savings, and better productivity. Or, it could stifle growth, slow operations, increase security risks, and lead to missed opportunities.

In the competitive insurance industry, there is no room for lackluster software. So, it’s essential to rid your system of all limitations. Read on to learn about common insurance software constraints, hidden costs, and how to transition to a modern system properly.

Identifying signs of insurance software constraints

Insurance software constraints often manifest through performance, scalability, compatibility, user experience, and security issues. If you’re experiencing any of these signs, it’s time to consider a software revamp:

- Performance issues: Your insurance software is slow, cumbersome, and fails to perform as expected. It frequently crashes, produces errors, and takes longer than usual to respond to requests or perform standard tasks.

- Limited scalability: The software lacks flexibility and can’t keep up with changes in your scale of operation, processes, or business model. It fails to accommodate growing customer bases or expanding services, and you need additional technology layers to manage operations. You also find it extremely difficult to build new features on top of existing functionality—either because of an overcomplicated inner architecture or an outdated technology stack.

- Integration hurdles: The software doesn’t integrate well with modern tools, platforms, or third-party services you need to run your business processes efficiently. You’re tethered to an old system, unable to leverage the advanced capabilities of modern technology.

- User experience flaws: Your system has obsolete user interfaces, lacks intuitive features, and has limited accessibility. Consequently, employees and customers struggle to use the software properly to achieve their goals.

- Security vulnerabilities: Your system lacks robust security measures, data protection protocols, and compliance frameworks. As a result, your adjusting insurance firm struggles to meet changing compliance standards and is highly vulnerable to breaches and malware.

You must acknowledge these signs as a call for modernization to ensure your bottom line is maintained.

The real costs of overlooking software limitations

Insurance adjusting firms overlook software limitations for various reasons, not the least of which is that upgrades take time and require a significant upfront investment. Faced with outdated software that’s still (somewhat) functionally viable, what should decision-makers do? It’s easy to say, “If it’s not broken, don’t fix it.” It can be harder to account for the real costs.

Here are the risks of outdated insurance software any decision-maker should keep in mind:

Data breaches

Outdated software increases the likelihood of a data breach by up to 65% (Kaspersky). It opens doors for cybercriminals to plant malware, hijack your system, and steal valuable customer data (or prevent you from using it).

The impacts of a data breach can be costly—legal fines, audit fees, ransom payments, lost revenue due to downtime, and reputational damage. So, it’s essential to modernize before the bad guys come knocking at your door.

Financial implications

The cost of maintaining and refactoring outdated insurance systems is burdensome as you grow or try to keep budgets under control. Wherever legacy systems exist, technical debt follows. As you pile code into outdated insurance software, glitches and bugs compound, and more resources are needed to fix performance issues. This leaves less time and money for innovation, making it difficult to remain competitive.

Operational challenges

Frequent crashes and downtime disrupt projects and reduce employees’ morale and productivity. It’s hard to resolve claims efficiently when your team is constantly fixing bugs, undertaking legacy maintenance, or looking for manual workarounds because your software doesn’t match your organization’s needs. These operational challenges often increase employee turnover and make it harder to attract new talent.

Reputational risks

Before IT modernization kicked into full gear, insurance adjusting firms could get away with using outdated systems. Relying on manual integration, replacing old code, and patching up problematic workflows were all part of standard operating procedures. But, the duct tape and a Band-Aid approach no longer cut it.

Customers now expect you to use the latest technology when handling claims. Overlooking insurance software constraints signals you don’t value innovation, security, and user experience, resulting in less customer trust and loyalty.

Transitioning to modern systems: taking the leap forward

In today’s fast-paced business landscape, shifting to modern systems isn’t just a nice to have—it’s a must. These systems streamline tasks, reduce errors, and speed up claims processing, increasing efficiency. They also provide real-time access to real-time data and analytics, helping you improve customer experience and make informed choices.

While initial costs are high, maintaining modern systems is less expensive in terms of both human and financial resources. Mckinsey estimates that modernization reduces your IT cost by about 41%, meaning upgrades pay for themselves over time. Similarly, time spent on training and upgrade disruptions won’t be lost. You’ll recoup it through higher employee productivity and less downtime.

That said, it’s essential to follow these best practices to smoothen your software transition:

- Assess your current systems to identify gaps that need to be filled.

- Set clear objectives for modernization.

- Decide whether you want a custom or ready-to-use solution.

- Choose a software vendor with a strong track record and relevant expertise. Ensure they can offer a tailored solution for your needs.

When you’re ready for a switch, Susco can make your transition less daunting.

Unlock the benefits of modernization with Susco

Imagine what’s possible when you’re not stuck in a reactive loop, always rushing to fix the next software issue. What could you achieve when you can innovate and adapt at the scale and speed that the next business evolution requires? Insurance IT modernization lets you answer these far richer questions and become more efficient and strategic.

At Susco, we’re committed to making your legacy system conversion successful. We audit your existing infrastructure and ease you into a modern system so that you can focus on what you do best—handle claims. Book a free assessment to discover how we can help build your future.